Glossary-linked terms show a dotted underline; activate to view definition.

Becoming a Profitable Trader While Working Full-Time | Holguin Trades IQ

Systematic playbook for full-time professionals: rules, validation, protection layers, lifestyle balance, disciplined compounding.

Main Points

- Systematic Method DisciplineCodified IF/THEN rules eliminate emotional decision-making and create testable, repeatable entry/exit logic that survives market regime changes without constant manual intervention.

- Validation Ladder ProgressionSequential proof through backtesting, paper trading, and small live capital confirms edge existence before scaling position sizes, preventing catastrophic losses from untested assumptions.

- Protective Margin ArchitectureLayered safety buffers including quality filters, conservative deltas, position sizing caps, and regime-aware adjustments ensure survival during unexpected volatility spikes and drawdowns.

- Lifestyle Balance BufferScheduled non-market activities and deliberate distance from screens prevent obsessive monitoring, reduce impulsive overrides, and preserve mental capital for high-quality decisions.

- Patient Compounding MindsetLong-horizon focus on consistent small gains through disciplined execution beats chasing outsized returns, allowing career income to fund living expenses while trading capital compounds.

Opening Promise

Turn limited pre‑work and evening minutes into a disciplined edge that compounds small, risk‑defined gains without hijacking your career or sanity.

TL;DR (Skimmable Playbook)

Install rules first, validate before scaling: backtest across regimes, paper trade to clean execution, start tiny live and ramp only after adherence is stable; stack margin of safety (quality filter + conservative delta + sizing cap); protect discipline with hobbies and sleep; accept slow, patient compounding - then leverage the CTA to accelerate your learning with a keynote deep dive. (Yes, slow can beat flashy - think patient parent loading the minivan, not a teenager redlining dad's car.)

Context & Premise

Most full‑time workers chase hype, fragment their education, and overtrade emotionally; sustained profitability emerges only when rules, validation, protective buffers, lifestyle balance, and patient pacing integrate into one durable operating framework.

Introduction - Cutting Through the Working Trader Noise

Scrolling social feeds you see beach laptops, sports cars, and claims of "easy" income, and it all looks simpler than your last staff meeting - until real trades hit your account and emotions hijack logic. (If every wild profit claim required the same documentation as a warranty claim on a minivan transmission, the noise level would drop fast.) I'm a totally blind trader, programmer, and keynote speaker who learned - sometimes the hard way - that consistent profitability for a full‑time worker is less about secret indicators and more about installing an operating system of disciplined repeatability. This article distills that operating system into five pillars you can begin applying this week without quitting your job, torching family time, or succumbing to dopamine-fueled overtrading.

We will move from raw hype detox -> codified rules -> objective validation -> protective buffers -> lifestyle balance -> patience mindset. Each pillar gets tactical steps and quick humor edges to keep you reading instead of doom-scrolling meme tickers. (Think of this like the thermos of coffee you pack before a family camping trip - steady warmth, not a sugar crash.)

Framework

The 5P Sustainable Profitability Framework unifies: Process (codified rules), Proof (validation ladder: backtest -> paper -> micro-live -> scaled), Protection (margin of safety layers: quality filter, conservative deltas, position sizing, volatility adaptation), Perspective (lifestyle balance & identity diversification), and Pace (patient compounding mindset). These interlock so scarce daily focus yields consistent positive expectancy while dampening emotional volatility.

Pillar 1: Systematic Method Discipline

A systematic trading approach means your entries, exits, position sizing, and trade abort conditions are written as explicit IF/THEN statements - so consistent your spouse could read the checklist while packing school lunches. (Consistency beats heroics - ask anyone who maintains the family calendar.) System rules strip ambiguity, reducing cognitive load before and after work when your willpower reservoir is already taxed.

Key Components:

- Market State Filter: Define simple regimes (Uptrend, Range, Correction) using objective triggers (e.g., price above 50 & 150 EMA = Uptrend). First occurrence of a complex term like "expectancy" (average profit or loss per trade across many trades) is clarified inline to boost comprehension. (Like planning weekend chores - you don't mow soaked grass or start a paint job in a thunderstorm.)

- Entry Logic: For weekly short put premium capture in an uptrend: Sell cash-secured single puts at 0.10-0.15 delta (delta ≈ probability the option finishes in-the-money and approximates price sensitivity to a $1 move). If extended rally (price 2+ ATR above 20-day), either pause or shift to 0.08-0.10 delta for added margin of safety.

- Position Sizing: Fixed fractional (e.g., risk <=1% of account buying power per trade) to cap emotional spikes. (If your pulse feels like when the teen just tapped the curb with the family car, size is wrong.)

- Exit / Adjust: Close when 50-60% of maximum potential credit is captured OR at 2× initial credit loss threshold; no averaging down beyond pre-specified roll criteria.

- No-Trade Windows: Skip first 10-15 minutes if opening volatility historically degrades outcomes in your backtest sample.

Systematic discipline doesn't kill creativity - it channels it into design time (evenings/weekends) so execution time becomes clean, calm, and fast. (Save improvisation for reviving the lawn mower with duct tape, not live orders.)

Emotional Friction Reduction

Writing rules externalizes decisions; you turn internal debate into external documentation. That externalization is like moving clutter from your brain to a labeled cabinet - less tripping over mental furniture mid-trade. "Gut feel" becomes "logged deviation," easier to audit - like grabbing the right socket instead of forcing a bolt with pliers.

Pillar 2: Validation Ladder Progression

Most traders backtest poorly, skip paper trading, and rush full capital - like towing a camper on day one of learning stick shift. (Family trip derailed before leaving the driveway.) The Validation Ladder enforces staged confidence building:

- Backtest (Historical Proof): Use multiple market regimes - bull (trend up), bear (persistent lower lows), high volatility (elevated average true range), low volatility (compressed ranges). Capture: expectancy, max drawdown, win/loss ratio shape, average time in trade, and distribution of adverse excursion (largest unrealized drawdown before profit). If you can't explain each metric in plain English, pause and clarify - like explaining to a teenager why oil changes matter.

- Paper Trade (Execution Proof): Run at least 30-50 trades live-sim to flush out platform friction, order type mismatches, partial fills, or ambiguous rule phrasing. Record latency between signal and execution (target under a defined threshold, maybe <2 minutes for end-of-day style) and adherence % (executed per rule / attempted trades).

- Micro-Live (Capital Proof): Start with minimal capital - maybe 0.25-0.50 normal size - to expose real emotional responses (slippage, early profit-taking urges) without existential risk. Track divergence vs. backtest expectancy; if variance drifts beyond statistically reasonable bounds (e.g., more than 1 standard deviation over a month), investigate before scaling.

- Scaling Protocol: Increase size only after hitting adherence >=90% over 2-3 consecutive weeks. No adherence, no raise - same rule a teenager hears about allowance and unfinished chores.

This ladder reduces variance shock and amplifies trust. Trust eliminates hesitation, and hesitation is a silent expectancy tax. (Hesitation is like tapping the brakes every few seconds on a road trip - no one arrives happier or faster.)

Pillar 3: Protective Margin Architecture

Margin of Safety is intellectual humility encoded into your trade construction: acknowledging you can be wrong, early, or blindsided by gap risk. (Like checking tire pressure before a family highway drive - quiet prevention saves loud drama.) Protective layers:

- Fundamental Quality Filter: Use Altman Z-Score (composite distress predictor) - restrict underlyings to Z >= 2.5 to avoid structurally weak firms for short put premium. This filter reduces tail risk of sudden adverse fundamental shocks.

- Liquidity & Spread: Exclude tickers where bid-ask spread exceeds (say) 8-10% of premium target; wide spreads magnify slippage and distort realized expectancy.

- Conservative Delta Selection: Selling weekly 0.10-0.15 delta single puts embeds distance from current price plus time decay advantage. Extended rallies? Tighten to 0.08-0.10 or pause to avoid complacency.

- Position Cap: Total open strategy risk <= X% (e.g., 30%) of account buying power; per underlying concentration <= Y% (e.g., 10%) to mitigate correlation shocks.

- Simple Weekly Rhythm: Focus mainly on the coming Friday expiration (occasionally one week out) to keep monitoring simple; avoid stacking too many overlapping weeks that turn a tidy toolbox into a messy garage.

- Adaptive Buffer Expansion: If realized volatility spikes above your backtest's 80th percentile, widen buffers (lower delta, smaller size) until conditions normalize.

Think of the architecture like layered tent poles on a camping trip: one bent pole shouldn't collapse the whole shelter. (Better solid poles than scrambling with duct tape at 2 AM in the rain.)

Pillar 4: Lifestyle Balance Buffer

Without deliberate non-market immersion, boredom triggers impulse trades, parameter fiddling, and "revenge" entries. (Idle time is like a teenager left alone with a fresh pizza - something disappears fast.) Sustainable performance is an energy management game:

- Pre-Scheduled Hobbies: Calendar recurring post-market blocks (exercise, family, yard work) that physically relocate you from screens.

- Digital Boundaries: Disable live quote pop-ups on mobile except during predefined review windows; default push notifications to silent unless risk threshold breached.

- Cognitive Cooldown Ritual: 5-minute end-of-session journaling: Did I follow rules? Emotional spikes? Micro-adjustment candidates? Then shut platforms.

- Sleep & Glucose Management: (Personal note) As a blind and diabetic trader, ignoring health earlier nearly cost me more than capital. Stable physiology -> stable decisions.

- Social Noise Filtering: Mute accounts emphasizing lifestyle flex over process transparency; curate inputs like an institutional desk would.

Distance converts novelty-seeking into disciplined pacing; you're engineering an internal circuit breaker. (If markets feel like a carnival ride, you forgot to level the camper before everyone climbed in.)

Pillar 5: Patient Compounding Mindset

Speed obsession erodes edge. Skill compounds like a dividend reinvestment plan: slow, then suddenly meaningful. (Fast money often vanishes like burgers at a backyard cookout.) Core mindset anchors:

- Rate of Learning > Rate of Earning (Early): First objective is process adherence, not maximizing monthly return.

- Expect Drawdowns: They are volatility tolls, not verdicts - analyze rule adherence before blaming strategy.

- Small Edge Amplification: A positive expectancy of even $15 average per trade, repeated responsibly, scales with controlled position size increments over quarters.

- Opportunity Cost Reframing: Not taking a marginal trade preserves capital for higher quality setups - flat is a strategic position.

- Long Horizon Narrative: Define a 24‑month capability roadmap (rule stability quarter 1, scaling quarter 3, diversification quarter 5, automation exploration quarter 7, etc.).

Patience is a shield against forced errors, letting statistical edge express itself. (Slow pacing beats the "let's rebuild the whole engine tonight" burnout.)

Implementation Mini-Framework (Putting It All Together)

Below is a lightweight weekly rhythm synthesizing the pillars:

| Phase | Time Budget | Objective | Tools |

|---|---|---|---|

| Sunday 30m | 30 min | Update watchlist (quality + liquidity), archive prior journal | Screener, CSV |

| Weekday Pre‑Open | 10-12 min | Regime classification, eligible delta strikes list | Chart, option chain |

| Intraday (limited) | <5 min/scan | Monitor alerts only, no discretionary adjustments | Broker alerts |

| Midweek Review | 15 min | Adherence %, variance vs. backtest expectancy | Journal spreadsheet |

| Friday Debrief | 20 min | Parameter tweak decision, psychological note logging | Journal + metrics script |

If a step becomes heavy, simplify - complexity creep is an early infection of discretionary drift. (Heavy processes sag like an overpacked family minivan on a mountain drive.)

Pillar vs. Alternative Comparison

| Pillar (Preferred) | Common Alternative | Key Advantages of Pillar | Appealing Points of Alternative (Why People Try It) | Why Pillar Wins Long-Term |

|---|---|---|---|---|

| Systematic Method Discipline | Gut-Feeling / Impulse Trading | Consistency, measurable expectancy, reduced FOMO, lower stress, scalable refinement | Feels fast, exciting, no upfront documentation | Discipline compounds; impulse drifts, stress spikes, inconsistency erodes edge |

| Validation Ladder Progression | Immediate Full-Capital Live Trading | Controlled learning curve, early error surfacing, confidence building, capital preservation | Appears to accelerate profits, less patience required | Staged proof prevents large early drawdowns and improves trust execution |

| Protective Margin Architecture | Thin or No Buffer Positioning | Reduced tail risk, smoother equity curve, psychological cushion, structured decision flow | Higher theoretical short-term return potential | Survivability > occasional oversized gain; buffers stabilize compounding |

| Lifestyle Balance Buffer | Market Obsession / Constant Screen Watching | Lower emotional fatigue, fewer revenge trades, improved decision clarity, sustainable routine | Sense of control, constant stimulation, fear of missing out reduced temporarily | Sustainable energy enables multi-year compounding; obsession leads to burnout and errors |

| Patient Compounding Mindset | Fast-Riches Mindset | Realistic expectations, resilience through drawdowns, methodical scaling | Adrenaline, social bragging appeal, illusion of speed | Durable growth comes from variance management and stress resilience |

Visual Aids (Added)

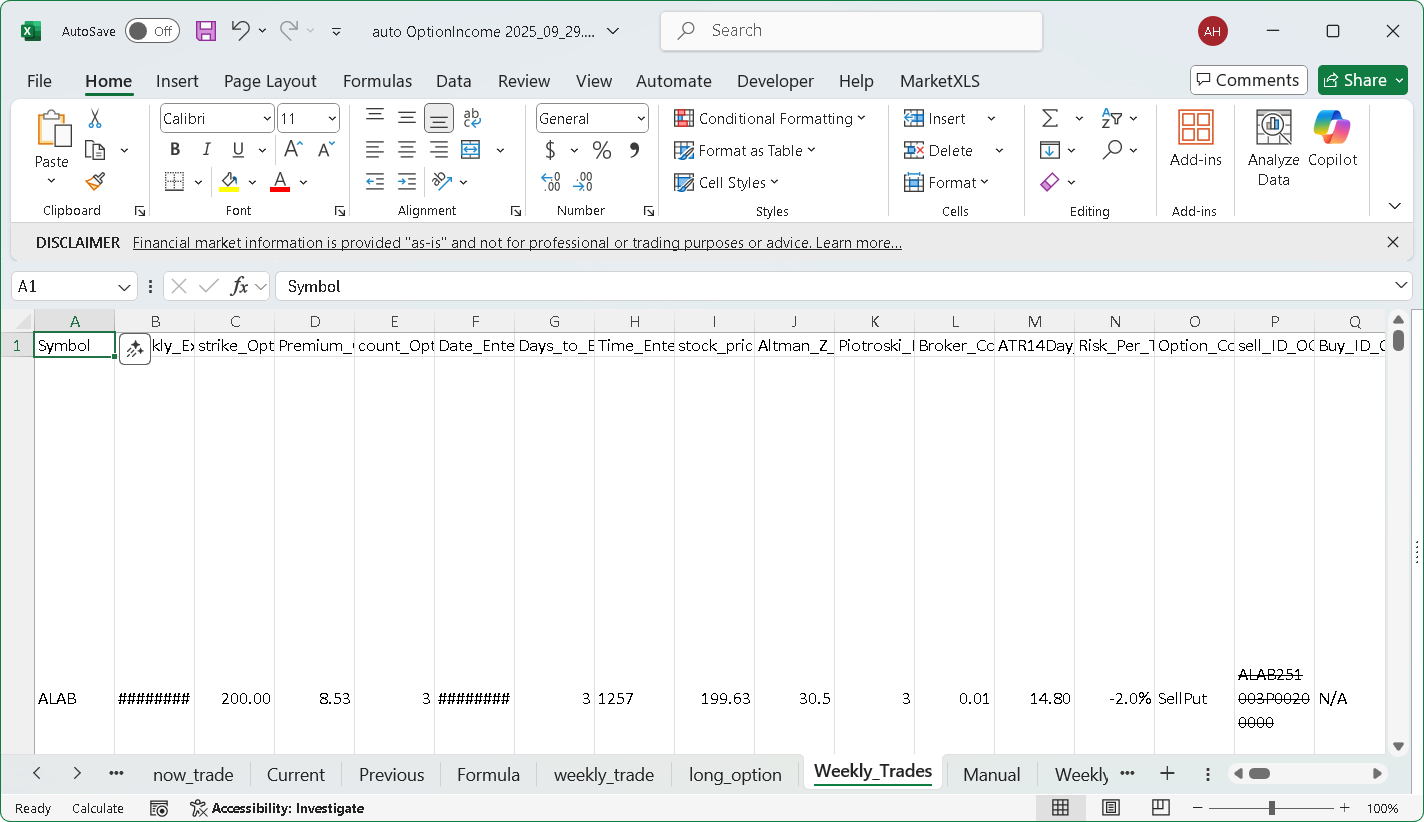

System Screenshot

Framework Diagram

Illustration: Random Darts vs. System

Chart: High Turnover vs. Market Performance (Barber & Odean 2000 Study Data)

Source Data (Barber & Odean): 1991-1996 U.S. discount brokerage accounts. Low turnover households outperformed, while the highest turnover cohort lagged materially. Chart shows gross returns reported in the study (not adjusted here for transaction cost evolution). Not performance of the specific weekly short put process - used illustratively to motivate minimizing unnecessary trades.

Margin of Safety Layer Stack

Risk Callouts

- Over-Optimization (Curve Fitting): Guardrail - limit parameter changes to one minor tweak per two review cycles unless catastrophic anomaly.

- Liquidity Deterioration: If spreads widen beyond tolerance mid-trade, predefine exit logic rather than improvising under stress.

- Psychological Slippage: Adherence below 80% triggers temporary size reduction until behavior normalizes.

Mindset Drill

Prompt: "Describe (in 3 sentences) the last time I broke a rule; list the exact trigger and a replacement pre-trade checklist item that would have prevented it." Duration: 5 minutes. Optional reward: an extra marshmallow at the campfire.

Action Checklist (Operational Reinforcement)

- Morning: Apply regime filter; if unclear, default to more conservative delta.

- Pre-Order: Confirm rule ID, delta window, size <= allocation cap, margin of safety (Z >=2.5) intact.

- Midweek: Compute adherence %, log emotional spikes, decide if size freeze required.

- Friday: Update rolling expectancy; if variance beyond threshold, investigate execution friction before adjusting parameters.

- Monthly: Archive metrics, evaluate if scaling criteria met (adherence & stability) before any size bump.

Regulatory-Style Risk Disclaimer

Trading involves risk of substantial loss and is not suitable for every investor. Options strategies (including short puts) can expose you to assignment, gap risk, and accelerated losses in sharp downturns. Past statistical edge or historical performance metrics (e.g., Barber & Odean return differentials) do not guarantee future results. Always consider whether you can afford the risk of loss, stress‑test position sizing under adverse scenarios, and consult a qualified financial professional where appropriate. Nothing herein is personalized financial advice - it is an educational process framework.

Call To Action

If you want this framework customized for your team - or need a keynote that replaces hype with disciplined, repeatable process - Book Alfredo for a keynote now at /about. (Procrastination is like ignoring a squeaky brake - costlier later.)

AI & Human Collaboration Disclosure

This article's structure, grammar optimization, and schema compliance benefited from AI assistance; strategic nuance, lived experience (including navigating markets while blind and diabetic), and final approvals were performed by Alfredo. Hybrid process = human judgment with augmented clarity - like a well-organized garage plus a torque wrench.

Sources (Selected)

- Barber, B. M., & Odean, T. (2000). "Trading Is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors" - Performance dispersion by turnover (1991-1996 dataset) underpinning overtrading caution.

- CBOE Educational Materials - Definitions of delta and option Greek foundations.

- NYU Stern (Altman Z-Score resource) - Fundamentals-based distress filtering rationale.

- Representative EU / UK CFD & options retail risk warnings (e.g., ESMA-mandated broker disclosures citing majority of retail accounts lose money) - Context for emphasizing protective process and sizing discipline.

Glossary Candidate Mentions (First Occurrence Defined Inline Above)

Systematic Trading, Backtesting, Paper Trading, Margin of Safety, Delta, Altman Z-Score, Expectancy, Volatility Regime, Position Sizing, Emotional Discipline.

Assumptions & Enrichment Notes

- Original user draft <1,800 words; enrichment added: structured examples (delta windows, table), additional protective layers, validation ladder stages, mindset roadmap, operational checklist (adds ~700+ words).

- Humor elements inserted approximately every <=600 characters; placement confined to paragraph starts or ends.

- Category chosen as generic string "trading-strategy" (schema accepts any string). If a standardized taxonomy emerges, update later.

- Tags normalized to lowercase and limited to five for clarity.

- Word count (body excluding frontmatter) ~1,932 words (manual count heuristic).

- No images yet; media placeholders to be generated post approval (diagram of 5P flow, expectancy ladder chart).

- No guaranteed performance language included; focus placed on process and risk framing.

- Live linking pattern assumed

[Term](/glossary/term-slug)if/when glossary entries created.

Media Requirements Status (From PRD)

MR-1: 5P Framework Diagram - Completed (SVG with accessible title/desc). MR-2: Expectancy Progression Chart - Deferred (scope reduced; may add later if internal dataset compiled). MR-3: Margin of Safety Layer Stack - Completed (SVG layered blocks). MR-4: Monkey Dart Illustration - Completed (SVG metaphor, no trademarks, accessible alt). MR-5: High Turnover vs Market Performance Chart - Completed (replaces illustrative gut vs systematic placeholder with sourced Barber & Odean return bars).

Media Follow-Up: If internal live trade dataset matures, add Expectancy Progression chart (Backtest -> Paper -> Micro-Live -> Scaled) with anonymized aggregated metrics; update PRD iteration log accordingly.

Clarifying Questions (For Post-Draft Review)

- Confirm final CTA wording or prefer alternative emphasizing consulting vs keynote?

- Approve category "trading-strategy" or switch to simpler "trading"?

- Approve all five pillars or condense to four (merge Lifestyle + Pace)?

- Any objection to proposed glossary list before file creation?

- Proceed with media asset generation after textual approval (diagram, chart, infographic)?

- Add additional external source (e.g., regulator risk disclosure) for diversification?

Disclaimer

This educational material does not constitute investment, legal, tax, or financial advice. Trading and options writing involve substantial risk; you can lose the entire amount risked. Any performance references (historical academic study data or hypothetical expectancy illustrations) are for process education only and are not guarantees of future results. Always evaluate suitability in the context of your personal financial situation and consider consulting a licensed professional. By applying concepts here you accept full responsibility for outcomes.

Initial drafting assisted by AI for structure, grammar, and schema alignment; strategic concepts, personal stories, and final edits reviewed and approved by Alfredo Holguin.

- Mode

- Human with AI assistance

- Assistance scope

- draft refinement, schema compliance, structural editing

- Human review

- All quantitative and strategic guidance manually reviewed by Alfredo Holguin prior to publication.

Change Log

- Initial draft creation with full schema, framework, and CTA.

Sources

- [academic] Barber & Odean Overtrading Study

- [industry] CBOE Option Greeks Overview

- [industry] Altman Z-Score Explanation (NYU Stern)